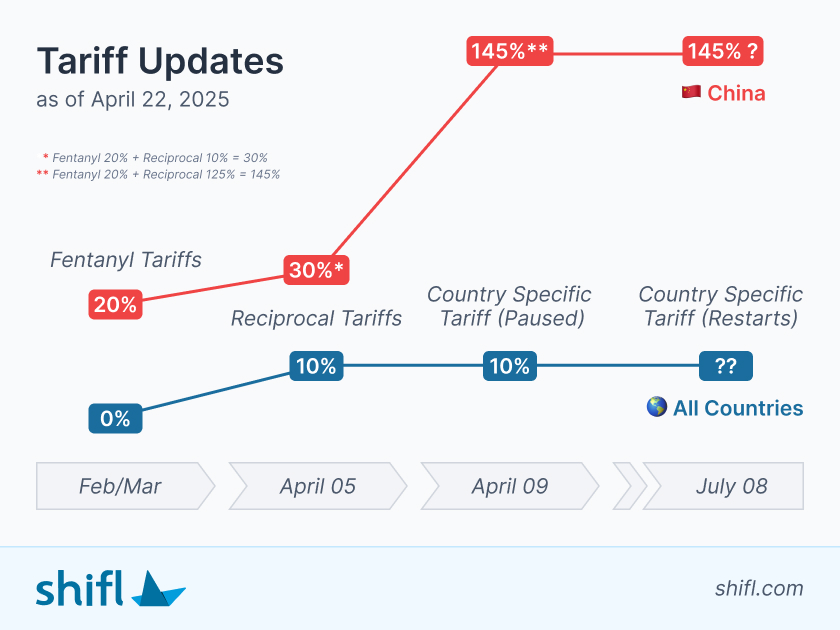

Over the past 10 days, there have been several updates to the reciprocal tariffs we covered in our April 2nd and April 9th emails. These tariffs, announced on April 2nd, were set to roll out in two phases: a 10% tariff on all countries starting April 5th, and additional country-specific tariffs (see the list) starting April 9th. On April 9th, the President paused the second phase for most countries for 90 days, except for China, where tariffs increased to 125% (totaling 145% with the 20% from Feb/March). Below is a summary of where things stand now:

China

- Most goods from China face a 145% tariff (20% from Feb/March + 125% from April 9), except for some exclusions listed later.

- Products with Section 301 tariffs keep those rates, plus the new tariffs, which can stack up high (some thought this meant 245%, but that’s just a mix-up of reciprocal + Section 301 tariffs).

- Tariff rates by shipment:

- Departed after Feb 4, Arrived after March 7: 20%

- Departed after April 5, Arrived before May 27: 30%

- Departed after April 9, Arrived before May 27: 145%

Canada & Mexico

- USMCA-covered products: 0% tariffs.

- Non-USMCA goods shipped after April 5: 25% tariff.

- Energy products and Potash After April 5: 10% tariff.

Highly Sanctioned Countries

(Belarus, Cuba, North Korea, Russia)

- These countries, already under heavy sanctions with minimal U.S. trade, are exempt from these tariffs (0%).

All Other Countries

- 10% tariff on cargo shipped after April 5.

- Additional country-specific tariffs (see the list) were paused on April 9 until July 8, unless a deal is reached with those countries.

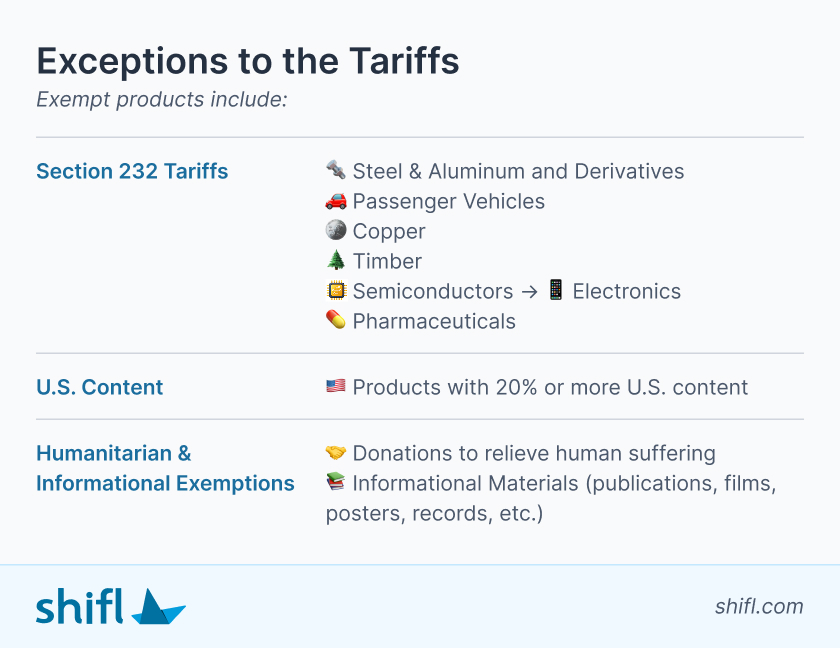

Exceptions to the Tariffs

There are a few exceptions to these tariffs worth noting. Keep in mind that some excluded products may still face other high tariffs, so the overall rate might not be low. Here’s the breakdown:

Section 232 Tariffs or Investigations

Products already under Section 232 tariffs or part of ongoing investigations (listed in the Federal Register) are exempt from these reciprocal tariffs to avoid overlap. Tariffs for these sectors may be announced soon. Exempt products include:

- Steel & Aluminum and Derivatives (HS codes under chapters 73 & 76, or other listed codes for steel/aluminum “Derivative” content). See Annex I

- Passenger Vehicles

- Copper

- Timber

- Semiconductors (investigation started April 1, 2025; comments due May 7, 2025)

- Pharmaceuticals and Pharmaceutical Ingredients (investigation started April 1, 2025; comments due May 7, 2025). See Annex II

U.S. Content

- Products with 20% or more U.S. content qualify for an exemption on the U.S.-made portion.

- Products with less than 20% U.S. content get no exemption.

Humanitarian & Informational Exemptions

The law requires exemptions for the following products, so they’re not subject to these tariffs:

- Humanitarian Donations: Donations of articles (e.g., food, clothing, medicine) to relieve human suffering.

- Informational Materials: Materials like publications, films, posters, records, photographs, microfilms, tapes, CDs, artworks, news wire feeds.