On April 2nd the President announced a new reciprocal tariff plan, enacted through an executive order proclamation. This sweeping policy introduces tariffs with broad implications, though it includes some nuanced exceptions. As this is a fluid an developing situation we will be posting updates here on top of our general email updates (you can subscribe below https://lp.constantcontactpages.com/su/7dNIG67 )

Over the past couple of weeks—starting with a meeting with major retailers on April 21st—the administration’s posture has been that tariffs on China will be coming down. The Wall Street Journal reported at the time that if there is no outreach from China, the US may unilaterally reduce the tariffs by 20%–60%. As the parties are expected to start discussions tomorrow, May 9th, in Switzerland, the New York Post is reporting that tariffs may drop by around 50%–54%, returning to the original 34% reciprocal tariff announced on April 2nd, plus the 20% fentanyl tariff. As of now, there are no official confirmations, but the move seems to align with recent messaging from the White House.

On May 8th, the US and the UK reached an agreement on trade. This is the first such agreement since the tariffs were announced on April 2nd and is expected to be the first of many. In this agreement, the 10% tariffs will remain, but there will be certain sectoral exemptions such as cars and steel. If this deal is an indicator of future agreements, we can expect tariffs to remain in place for most countries, with certain sectors having different rates per country.

On Wednesday, April 9, 2025, President Trump announced a 90-day pause on additional reciprocal tariffs for countries not retaliating against U.S. trade actions, capping their rate at 10%—reverting to the April 5th baseline.

Meanwhile, China’s total tariff rate jumps to 125%, adding a 105% reciprocal tariff on top of the 20% baseline, and additional 21% to the 84% announced yesterday escalating trade tensions.

This story is developing and will notify soon as more details arise

- Examples on the actual duty rates based on the combination of the various tariffs.

- Exceptions for some products.

- De-Minimis Loophole removed. Leveling the playing field for US Importers.

- Important Trade Alert from the CBP.

- Customs Bond Alert with increase Duties expected

Starting from tomorrow April 3d. All Auto Imports will have a 25% tariff rate as previously announced

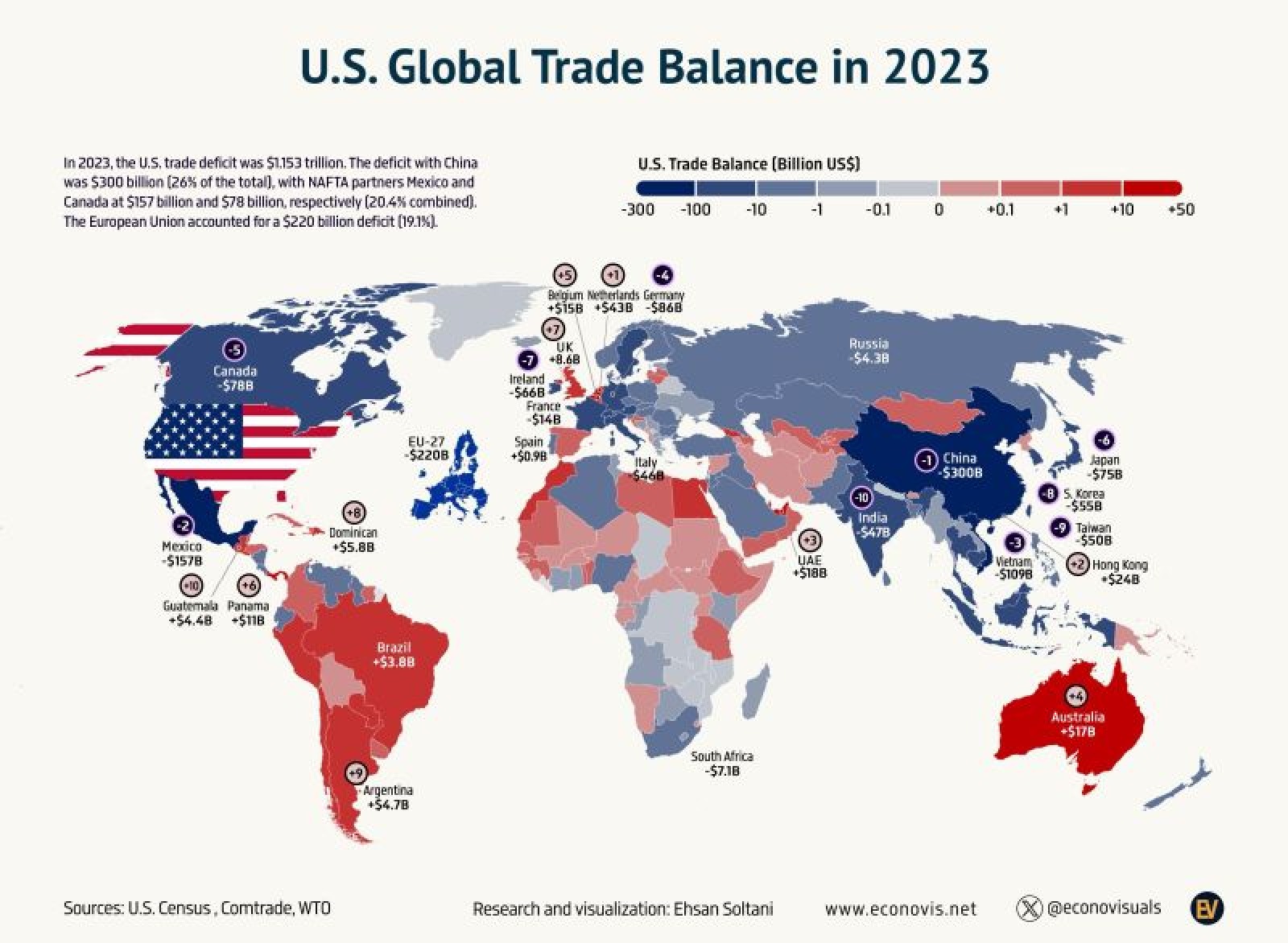

The reciprocal tariffs announced will be 50% of the total aggregate tariffs and trade barriers of each country with a a baseline of 10% for countries with lower or no tariffs.

See list below

🇨🇳34% on China

🇪🇺20% on EU

🇨🇭Switzerland 31%

🇻🇳Vietnam 46%

🇹🇼Taiwan 32%

🇯🇵Japan 24%

🇮🇳India 26%

🇰🇷Korea 25%

🇹🇭Thailand 36%

🇰🇭Cambodia 49%

🇬🇧Great Britain 10%

🇧🇩Bangladesh 37%

🇲🇾Malaysia 24%

🇿🇦South Africa 30%

🇵🇭Philippines 17%

🇮🇱Israel 17%

🇵🇰 Pakistan 29%

🇱🇰Sri Lanka 44%

Stay tuned as we bring you real-time updates on this evolving story. Have questions or insights? Let us know—we’d love to hear from you!

Key Details from the Executive Order

10% Baseline Tariff

-

- Under the authority of the IEEPA, the President is imposing a 10% tariff on all imports, regardless of trade deficits or existing tariffs. (this is referred to as the baseline tariff)

-

- Timeline: Effective April 5, 2025, at midnight.

Individualized Reciprocal Tariffs

-

- Higher, tailored tariffs will apply to countries with the largest trade deficits with the United States.

-

- List of countries: List of countries: While the proclamation does not specify any country or tariff rate, the WH shared a list of 150 countries and their respective aggregate tariffs (based on actual tariffs + VAT and other trade barriers).

-

- Additionally, the WH told CNBC that the percentage on China will be on top of the current 20%, which means that the total base rate for Chinese imports will be 54%.

-

- It is unclear at the moment if the tariff rate on these 180 countries will be on top of the baseline 10% and when the tariff for these countries will go into effect. We will update you as details become available.

-

- Timeline: Timeline: Effective April 9, 2025, at midnight.

Exclusions

The following goods are exempt from these tariffs:

-

- Articles subject to 50 USC 1702, including Personal Communications, Humanitarian Donations, Informational Materials, and Travel Transactions.

-

- Steel, aluminum, autos, and auto parts are already subject to Section 232 tariffs.

-

- Copper, pharmaceuticals, semiconductors, and lumber articles.

-

- Articles that may become subject to future Section 232 tariffs.

-

- Bullion.

-

- Energy and certain minerals unavailable in the United States.

Canada and Mexico (USMCA)

USMCA-compliant goods: 0% tariff.

Non-compliant goods: Initially set at 25%, but if the 25% fentanyl tariff is