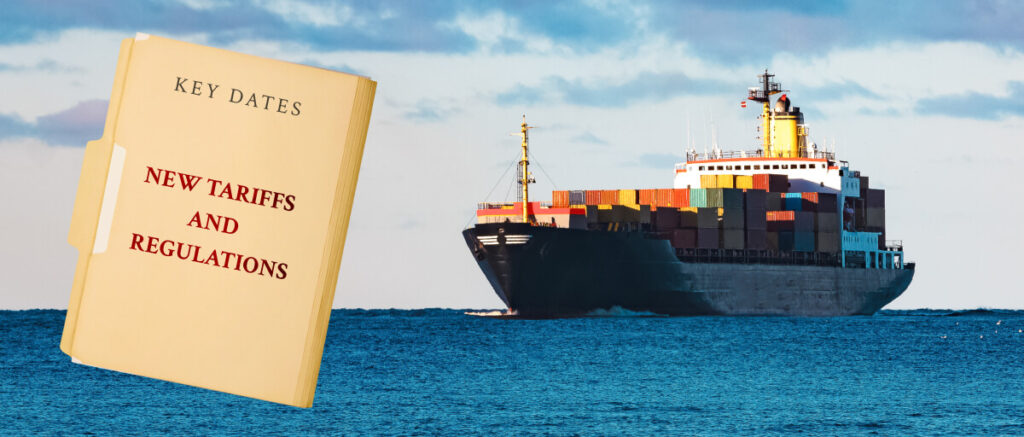

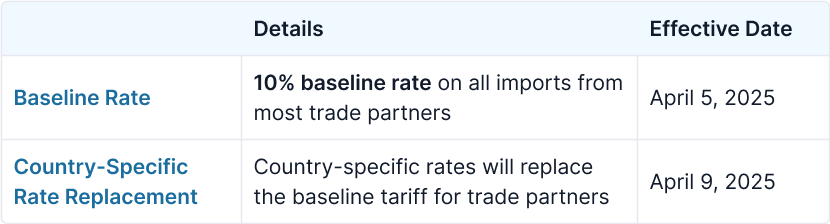

Following the April 2, 2025 announcement of reciprocal tariffs, CBP issued guidelines over the weekend to clarify key details. Below is a breakdown of the important points and their corresponding information.

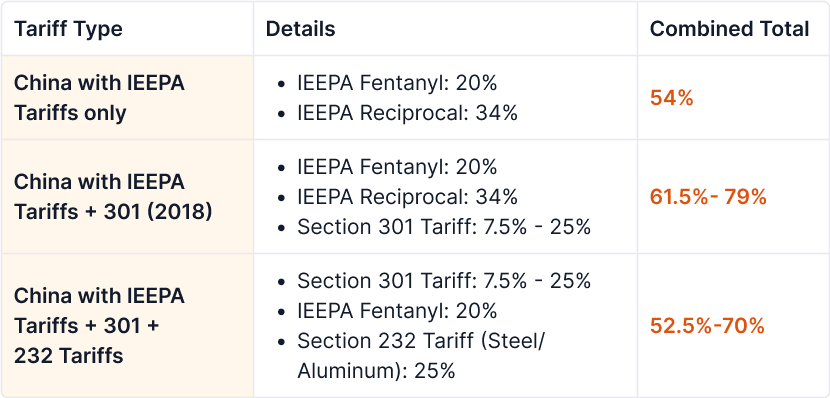

Examples

Exceptions

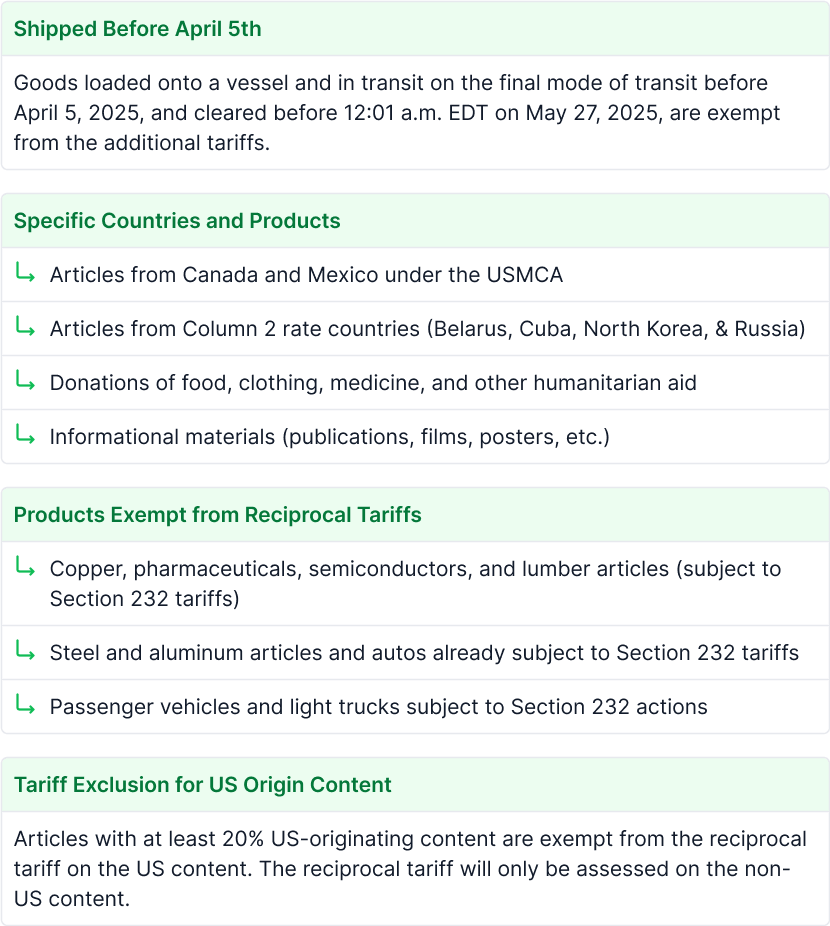

Below are the exceptions to the Reciprocal Tariff:

De minimis

Effective May 2, 2025, the loophole for duty-free goods from China will no longer be in effect:

Non-postal imports:

Goods sent through means other than the international postal network will be subject to all applicable duties and must be entered through standard US Customs and Border Protection (CBP) procedures

International postal packages:

Packages valued under $800 will face a duty rate of 30% of their value or $25 per item, increasing to $50 per item after June 1, 2025

Trade Alert

Tariffs May Increase Customs Fraud Cases:

Higher tariffs could lead to more cases of customs fraud, so companies should check trade rules and practices, ensure accurate trade data, review customs forms for errors, and encourage honest reporting to mitigate risks.

CBP is increasing scrutiny on imports, sending out more CF-28 requests for information, including payment history, product literature, and product samples for review.

Customs Bond Alert

Tariffs may require an increase in bond:

With the recent high tariffs on imported goods, your customs bond may be affected. The increased duties, taxes, and fees on imported goods could result in your current bond being inadequate. Since customs bonds are calculated based on 10% of total annual duties, the increased tariffs may necessitate a higher bond amount to meet U.S. Customs and Border Protection (CBP) requirements.

If you receive a bond insufficiency notice from CBP, do not rely solely on the minimum bond amount stated in the notice. Determine the necessary bond amount to protect your interests and limit costs.

Stay tuned as we bring you real-time updates on this evolving story. Have questions or insights? Let us know—we’d love to hear from you!