Below is an important update regarding recent tariff changes, including increased rates and the removal of exemptions, which may impact your shipments.

Overview

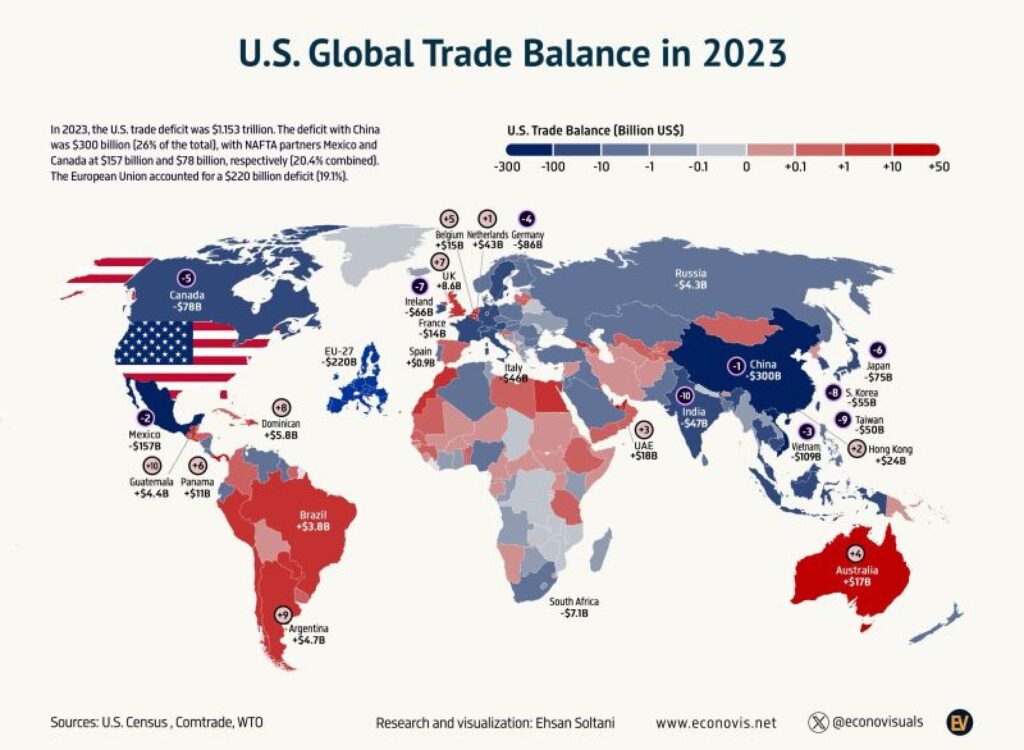

In March 2018, President Trump imposed a 25% tariff on steel and a 10% tariff on aluminum under Section 232 of the Trade Expansion Act of 1962, aiming to boost U.S. industries and ensure access to these materials in case of national emergencies. Some countries were exempted initially, and later additional countries were added to the exclusions and exemptions, allowing China to find ways to circumvent the duties by reprocessing materials through those nations.

Feb 10 Executive Order: Key Changes to Tariffs

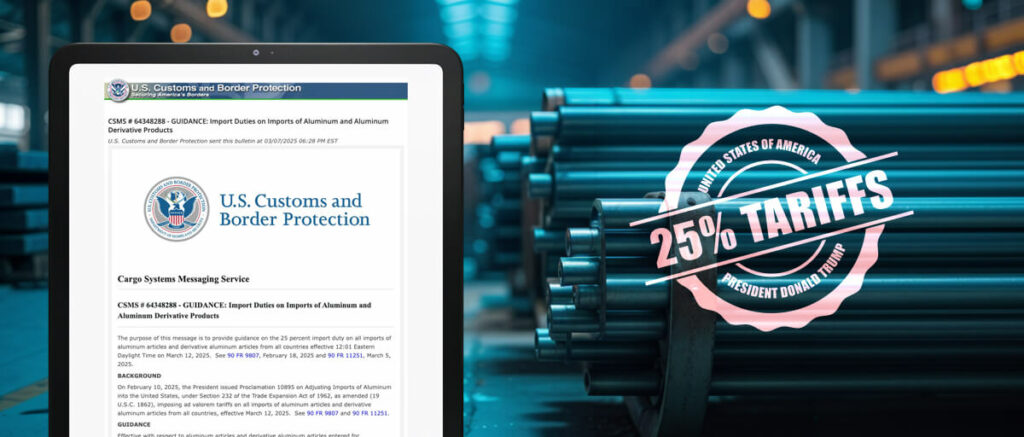

Due to the concerns mentioned above, the executive order signed on Monday, February 10th, removes all exclusions and exemptions for other countries. Additionally, it increases the tariff on aluminum to 25%.

- Effective Date: The White House has set March 12 as the date for these changes to take effect.

- Products: The aluminum tariff for China will increase to 25%, and all previous exclusions and exemptions for other countries are now removed. A detailed list of affected countries and products will be published soon, with further information provided as it becomes available.

- Enforcement: The executive order includes directives aimed at “cracking down on tariff misclassification and duty evasion schemes.” While specific enforcement actions are not yet detailed, this indicates stricter compliance measures and a stronger emphasis on accurate tariff classification.

For more details, you can view the official Proclamation and Fact Sheet directly on the White House website from the below links:

- https://www.whitehouse.gov/presidential-actions/2025/02/adjusting-imports-of-steel-into-the-united-states/

- https://www.whitehouse.gov/fact-sheets/2025/02/fact-sheet-president-donald-j-trump-restores-section-232-tariffs/

We will continue to monitor developments and keep you updated with any further changes. Please feel free to reach out if you have any questions or need additional information.

Leave a Reply